unrealized capital gains tax meaning

Its normal to see the investments in your portfolio going up and down in value over time. Currently the tax code stipulates that unrealized capital gains are not taxable income.

I Chose This Image To Represent Management Operating Agreements This Image Displays That An External Management Compan Management Company Incentive Management

But then there are two groups of people who dislike the idea.

. Unrealized gains also referred to as paper gains are NOT taxable. Capital gains are only taxed if. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that appreciation until the item is sold.

But just because you see some gains or losses. It is the theoretical profit existent on paper. Ron Wyden D-Oregon announced on Tuesday that he is working on a mark-to-market system that would tax unrealized capital gains on assets owned by millionaires and billionaires.

The fair market value of the Trust Fund on the last day of a fiscal year shall be determined without including the Trust Income for the fiscal year. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. Unrealized capital gains tax meaning.

Taxing unrealized capital gains at death theoretically increases the revenue-maximizing capital gains tax rate because taxpayers are less likely to hold onto assets until death to avoid the higher rate. Acc 541 Week 1 Individual Assignment Accounting Standards Boards Paper Homework Help Quiz With Answers Ashford University. Unrealized Capital Gains Tax.

Meaning that when assets such as stocks crypto and real estate appreciate that value is taxed at the same rate as your income. The investor can plan when to sell the security and realize his gains. An unrealized gain is when you have not yet sold the thing.

November 29 2021 by Brian A. Unrealized gains and losses are the day-to-day increases or decreases in an assets value such as a stock. This proposal suggests that we should be taxing unrealized capital gains as income.

Unrealized gains are not taxed by the IRS. In reality it is a tax on wealth. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

This policy allowed the richest Americans to get richer by minimizing their tax obligations. Until the stock is sold for cash the gain or loss remains unrealized thus unrealized gains and losses are often referred to as paper profits or paper losses. The purpose of this tax was to help the millions of American who needed financial help.

A gain or a loss becomes realized when you sell the investment. Unrealized Capital Gains Tax In this presentation I will be discussing a proposal brought by Janet Yellen at the department of treasury and our current federal government. Unrealized Capital Gains means the excess of the fair market value of the Alabama Trust Fund on the last day of the fiscal year over the fair market value of the Trust Fund on the last day of the immediately preceding fiscal year.

I mean I think I had a ton of unrealized capital gains last year and if I had to pay taxes on that I would have had to sell stocks. Unrealized Capital Gain means with respect to any Reference Obligation if the Current Price of such Reference Obligation is greater than the Initial Price in relation to such Reference Obligation then a such Current Price minus such Initial Price multiplied by b the Reference Amount of such Reference Obligation. Realized capital gains occur on the date of exit as this triggers a taxable event whereas unrealized capital gains are simply paper gainslosses.

The distinction between unrealized and realized gainslosses is an important one because there are tax implications that could impact your tax bill at the end of the year. Normal capital gains tax only applies once you sell it and realize the gain. The unrealized capital gains tax came into discussion in 2021 when Joe Biden and the Democrats found a new way to tax billionaires.

Holding security for a long time may reduce the tax implication as it will be treated as long-term capital gains tax. Taxing unrealized capital gains also known as mark-to-market taxation. An investor is NOT taxed until the investment is exited and a profit is obtained.

A realized gain is when you actually turn that into dollars by selling the thing. Currently the tax code stipulates that unrealized capital gains arent taxable income. This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset.

Furthermore even when capital gains are realized they may be taxed at lower rates than other types of income. Our estimate assumes that realizations are 20 percent less responsive to a change in the capital gains tax rate when unrealized gains are taxed at death. This means you dont have to report them on your annual tax return.

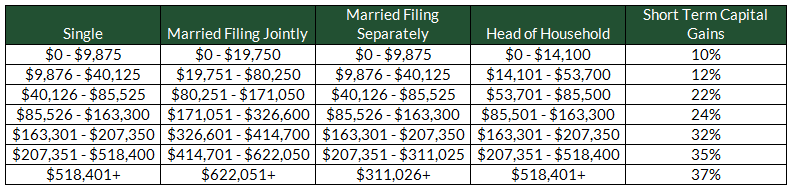

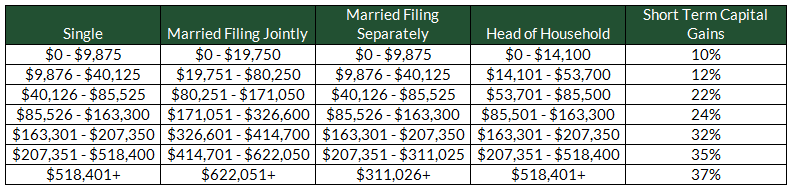

Unrealized Capital Gains Tax Capital Gains Tax Rate 2022 It is widely believed that capital gains are the result of earnings made through the sale an asset such as stocks real estate stock or a company and that these profits constitute taxable income. The new proposed tax will be on very very wealthy people who have not actually turned those large investments into cash. Why is this important.

What is an unrealized capital gain. Just its just hard to do. When an investor sells an asset stock that has gained or lost value the.

Unrealized capital gains are not taxed meaning a person who owns an asset that is worth more and more each year can defer paying income taxes. What this means is that someone who owns stock or property that increases in value does not pay tax on that. The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains.

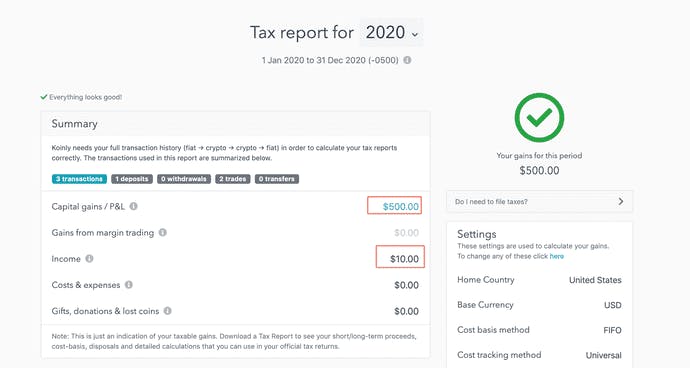

Germany Crypto Tax Guide 2022 Koinly

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Yield Cgy Formula Calculation Example And Guide

What Is Capital Gains Tax 2021 Robinhood

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What Is Capital Gains Tax 2021 Robinhood

Capital Gains Tax B C Explained Leo Wilk

What Are The Change In Use Rules What Are The Tax Implications Intermediate Canadian Tax

Avoid The Tax Hit On Mutual Fund Capital Gains Distributions

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax System In Nepal An Overview Corporate Lawyer Nepal

What Is A Step Up In Basis Cost Basis Of Inherited Assets

What Is The 2 Out Of 5 Year Rule

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Many Users Are Confused When They Try To Report Their Backdoor Roth In Turbotax This Article Gives Detailed Step By Step Inst Turbotax Roth Federal Income Tax

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption

/GettyImages-187569189-5c497c1cb19141b4aea3488073f808a8.jpg)

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)